Towards de-dollarization and a multipolar world

SERGIO NAVAS

With the end of World War II and the establishment of the Bretton Woods Agreement, the US dollar became the world's hegemonic currency. The greenback has governed international trade and currency exchanges, while serving as a unit of account and reserve currency. This omnipresence has translated into influence over the global economy and has given the White House tremendous financial and political power for more than 70 years.

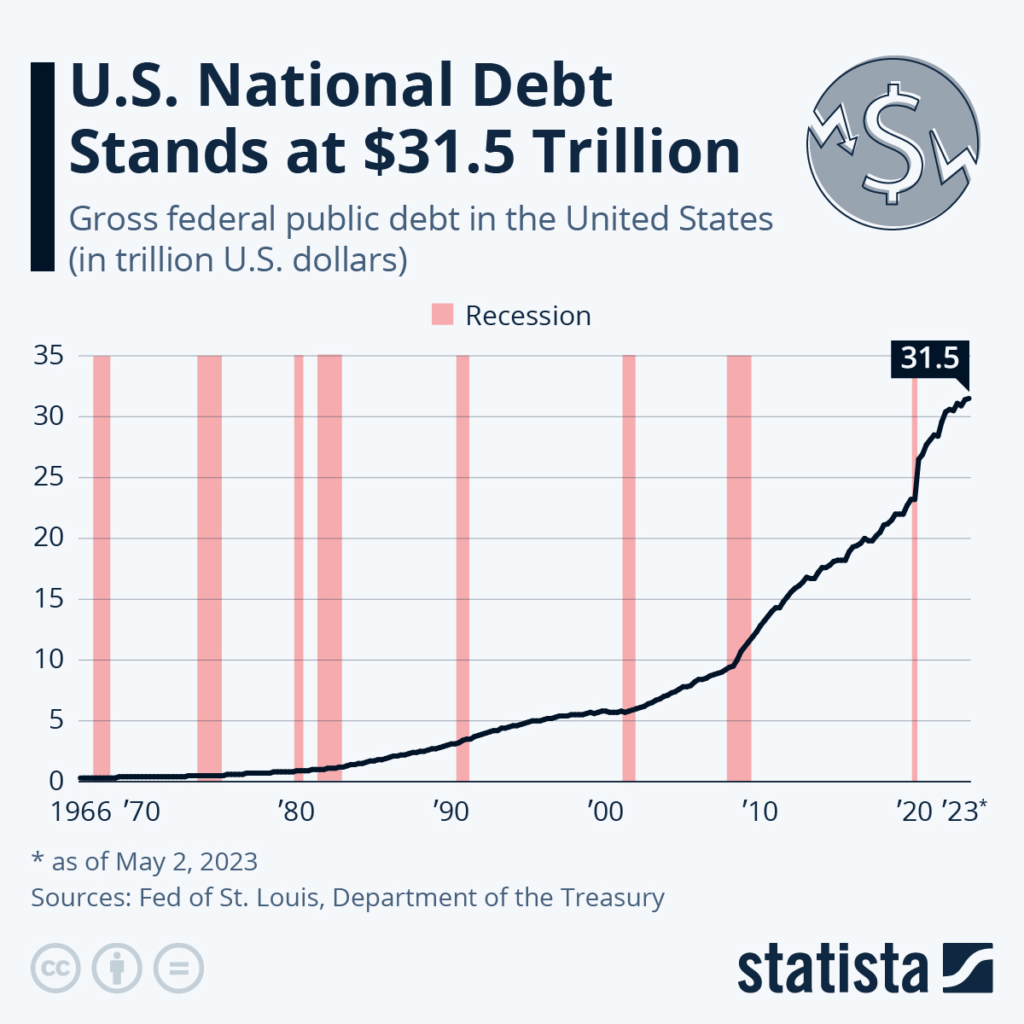

For example, the high world demand for dollars allows the United States to live beyond its means. The United States has a growing deficit that it can only cover by raising its debt ceiling, and it has done so more than 70 times since 1960. While a developing country would bleed to pay off this huge dollar debt, facing high rates of interest and pressure to reduce its public spending, the White House simply raises its debt limit and borrows cheap money in the form of treasury bonds. Simply put, the United States is the only country that has no problem paying down a debt in dollars, since it can create the currency whenever necessary.

Additionally, global institutions such as the International Monetary Fund (IMF) and the SWIFT payment system are, in effect, financial arms of the White House. Although they are supposed to be neutral and serve international interests, they actually target specific countries by applying economic sanctions, causing serious damage to those who oppose US guidelines. The dollar is at the center of these financial structures and its constant deployment to achieve particular interests is what has been called the "weaponization" of the currency. In recent years, these institutions have frozen assets and restricted trade from countries like Iran, Libya, Venezuela and Russia, making more and more nations fear being targeted by US financial power. The dollar has lost its purpose as a "trusted world currency" and emerging powers are eager to build a less dangerous alternative.

The American hegemon and its financial system are increasingly uncomfortable with China's global rise. Since joining the World Trade Organization (WTO) in 2001, the Asian country has accelerated its rise and has become the world's second nominal GDP and the largest measured in Purchasing Power Parity (PPP). This exponential growth has paved the way for thinking of a multipolar world, creating momentum in which various countries show their weariness towards the prescribed Western model of globalization and its hypocritical discourses on democracy.

The financial system promoted by the Anglosphere has overwhelmingly benefited the already developed countries of the Global North, while unleashing systemic crises in the Global South. As a result, many non-Western nations yearn for a global order without a hegemonic force. It is not a question of replacing the United States with China as the dominant force, but of establishing multiple poles, each enjoying its important sphere of influence. Thus emerges a new global vision that allows for more “win-win” situations among developing countries, and that should lead to fairer trade, loans, and technology transfers.

During the Cold War, the world had two fixed and obvious poles of influence. However, with the collapse of the Soviet Union, the United States became the undisputed superpower of a unipolar world. For most of the second half of the XNUMXth century, China kept a low profile and was not a prominent player in world politics. This approach worked remarkably well for his rise. Now the world has changed: today's China has greater ambitions in the international sphere and has become the number one rival of the United States. Given these transformations, China neither wants nor can keep a low profile.

The ongoing trade war between the two largest economies, started by then-President Donald Trump and continued under the Joe Biden administration, continues to worsen. This dispute has gone beyond purely economic aspects, increasingly involving global diplomacy, and even threatening to have a military scenario. The US used Taiwan as a pretext to escalate its confrontation with China, and now the island symbolizes the greatest geopolitical risk between the two superpowers. As more countries are considering taking sides and serious decoupling appears to be underway, the buildup to this economic breakdown is fueling the formation of a multipolar world, driving the need for an alternative financial architecture. In this scenario of tremendous complexity, China is obliged to play its cards prudently, using a foreign policy that builds alliances and avoids new enemies. The multipolar world must be built on peace in the Taiwan Strait.

Various academics, think tanks, and geopolitical strategists acknowledge the growing relevance of a “multipolar world.” The United States dominates one pole and China the other. It is not yet clear which nations will form the other centers of power: India is an obvious candidate, while Russia, Iran or Saudi Arabia may establish smaller but regionally powerful spheres of influence. A strategically autonomous European Union appears to be the wish of French President Macron and other European leaders, but most of the EU appears comfortable with subservience to the United States.

The new world order will probably not be as rigid as the structure of the Cold War. The emerging poles may continue to overlap economically while competing politically. Europe, for example, criticizes India and China, but is not going to disassociate itself from their gigantic markets. An increasing number of countries, especially in the Global South, do not want to align themselves wholeheartedly with any one superpower. They want to be independent, pursue their national interests, and work collaboratively with multiple poles.

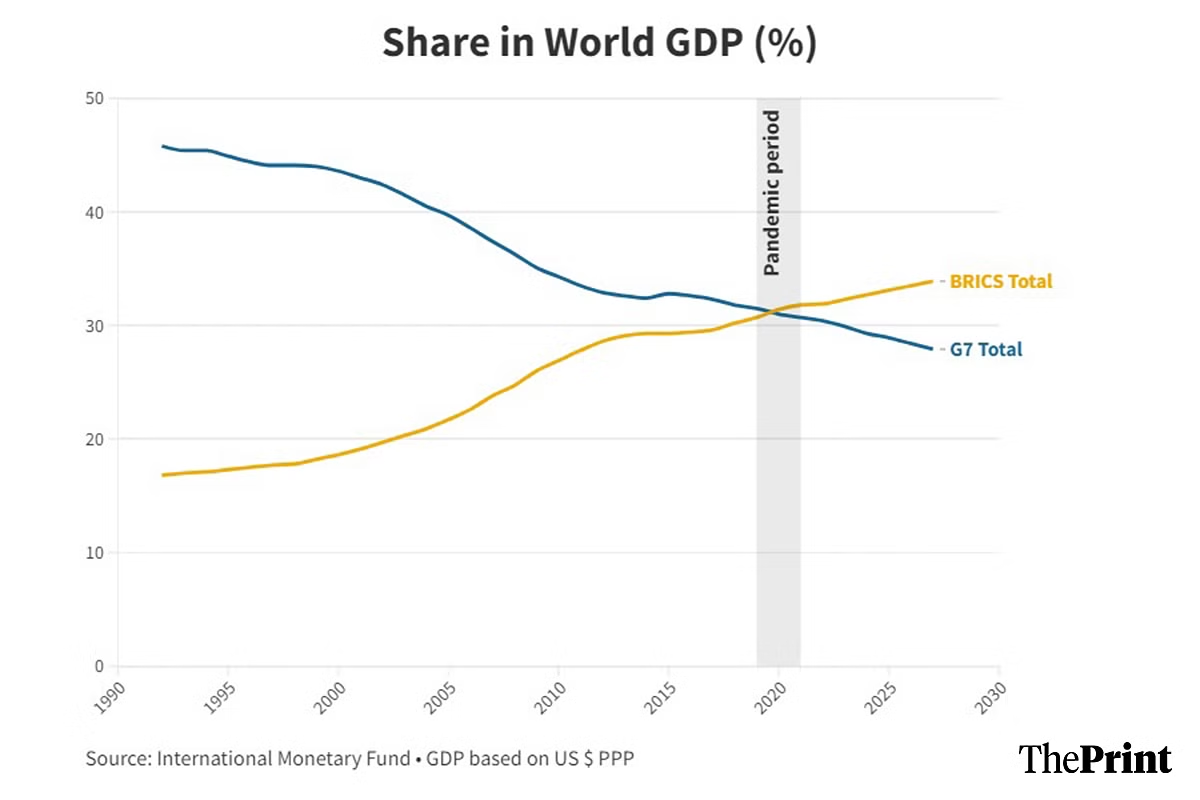

In this new world order, the geopolitical importance of the BRICS countries will increase. The influence of these large emerging economies (Brazil, Russia, India, China and South Africa) is unstoppable in international affairs, as together they recently exceeded the combined GDP of the G7 (Group of Seven most advanced economies: United States, Japan, Germany , France, United Kingdom, Italy and Canada).

The BRICS also account for 41% of the world's population, 24% of world GDP and 29% of the total land area. For these reasons, it is not surprising that such governments are considering an alternative to dollar hegemony. The top five countries in the alliance, as well as those expected to join in 2023 (some include Saudi Arabia, Argentina and Egypt), share a goal of reducing their dependence on the US dollar while increasing the group's economic ties. .

For these countries, the de-dollarization process means both trading directly with their own currencies and gradually replacing their dollar reserves. This long process has already begun and will strengthen the financial powers of the BRICS alliance. They have much more to gain: de-dollarization would also translate into less geopolitical power for the United States, reducing its influence over the global economy and lessening the damage from possible economic sanctions. If the world appetite for dollars weakens, the White House will have to reduce its national spending and also act internationally according to its real financial possibilities. Such a change would represent a significant gain for a truly multipolar world.

However, it would be a mistake to ring the bell for the “end of the dollar”, as some journalists and analysts have tried to claim. For the foreseeable future, the US dollar will remain relevant and the dominant currency in the Western world. At the same time, China does not enjoy the global confidence to make the yuan the most appreciated currency, and the importance of the European euro and the Indian rupee could also grow in terms of market share in the coming years. Most countries are not looking for a new hegemonic currency that grants enormous privileges to a single nation but for a fairer global system. Within this context and in view of the emergence of new financial structures, China can rely on its long-term planning capabilities and add allies for the multipolar world.

The BRICS are currently discussing a system to bypass the dollar entirely, both in trade and in international reserves. Several analysts consider that the BRICS want to support the new monetary system with raw materials such as gold, silver, oil and rare earths, making the structure more reliable. This approach would make it really attractive to hold international reserves, since several countries would prefer the BRICS system instead of “weaponizable dollars”, which are also a fiat currency without any commodity backing.

Another plan on the table is to have long-term mutual agreements to trade directly between the BRICS currencies. Several treaties have been signed and part of the energy transactions are already carried out with the Chinese renminbi. We are facing the formation of a new financial structure. The New Development Bank (NDB) is already a direct competitor of the International Monetary Fund (IMF). The financial coalition of BRICS members is so powerful that even the most pro-Western media are beginning to recognize it. The success of the BRICS in de-dollarizing would automatically mean a new world order.

The idea of BRICS+ (expanding the alliance with new members from Latin America, Africa, the Middle East and Southeast Asia) could send an important message of international cooperation and anti-hegemony. This group would be too large to be sabotaged by the Western powers, and its plurality the best symbol of a truly multipolar world. However, the cohesion of the group is not guaranteed and members must work hard to keep it on track. China is the natural leader to leave the unipolar world behind and challenge the US hegemonic order, but it needs to cooperate with the Global South. For China, it is of paramount importance to manage the alliance "generously", since BRICS+ is the organization that could bring more stability and economic benefits to the majority of the world's population.

Sergio Navas is a Colombian journalist.